During a Loan Closing Your Institution Must Use Which Form

During your home loan process lenders typically look at two months of recent bank statements. This form will disclose all costs related to the home purchase including loan fees real estate taxes and other miscellaneous expenses.

Terms To Know Before You Start Your Home Search Real Estate Terms Home Buying Process Real Esate

If the requester was a foreign financial institution because you have financial accounts with that institution.

. For applications taken by telephone the information in the collection form must be stated orally by the lender except for information that pertains uniquely to applications taken in writing. Must be in table form substantially similar to the model forms in Appendix H of Regulation Z Proper use of the sample forms in the regulation complies with the form and layout requirements An interior table within the larger table must contain the current and new interest rates and payments and due date of the first new payment 22. You want to walk out of there excited and relieved not wondering whether you just signed away your firstborn.

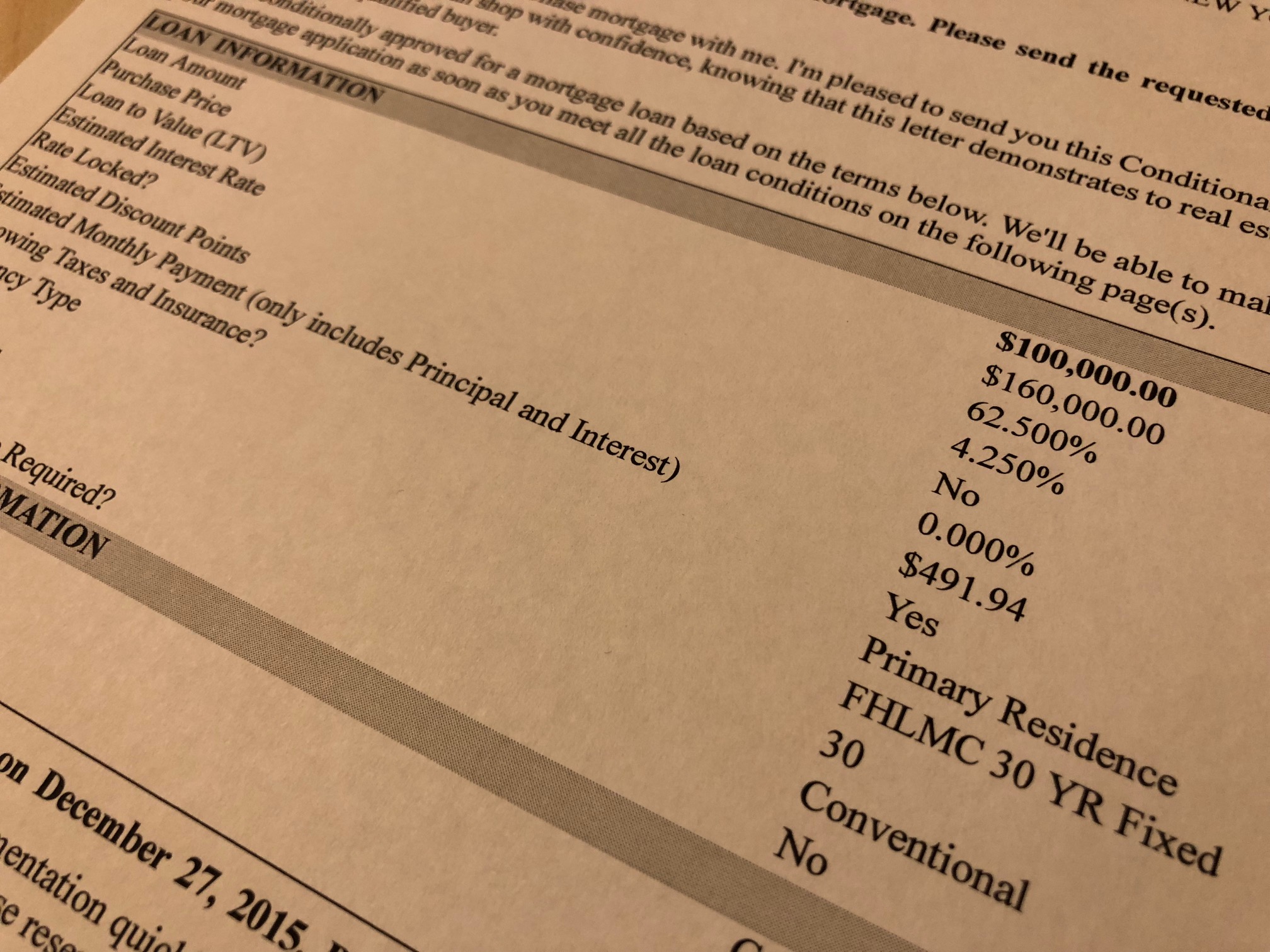

Even if your income is exactly the same the fact that you are. The number-one mistake might be to let anyone rush you. The Closing Disclosure is a five-page form that describes the critical aspects of your mortgage loan including purchase price loan fees interest rate estimated real estate taxes insurance closing costs and other expenses.

Ignore questions from your lender or broker. Acceptable Funds For Closing. For example if a borrower pays points of 300 and other mortgage interest of 300 the lender has received 600 of mortgage interest and must file Form 1098.

Close Your Own Loan also offers refinance options but no specialty loans. Buy a big-ticket item. All the details of your loan.

Bundrick CFP Dec 20 2019. This lenders automated underwriting works with loans that have set criteria such as conventional fixed-rate and ARM mortgages FHA and VA loans. Compare it to the good faith estimate you signed.

Let someone run a credit check on you. Once your loan is approved and cleared to close the mortgage team will have 3 days to finalize all of your closing documents so youre ready to complete the transaction. A record that the borrower received the notice must be retained by the lender.

Identification card drivers license passport etc must be returned to the Lender and should not be introduced into your closing file for retention. After you have prepared for the costs chosen your home had your purchase offer accepted applied for your home loan supplied all necessary paperwork and met initial loan conditions through underwriting then the home closing process begins. Ask your lender or closing agent.

3393 If improved real property securing a loan is located in a SFHA and flood insurance is available then the lender must require the borrower to obtain the proper amount of flood insurance before closing the loan. You will need to use these forms in the preparation of your US tax return. The Real Estate Settlement Procedures Act of 1974 RESPA 12 USC.

That includes the amount type and term. Familiarize yourself with some of the key documents you will be signing so that you know what to look for when you get them. So barring any unforeseen complications youll be sitting at the closing table and signing the property deed on your new home a mere 72 hours from the time you receive.

Review the HUD-1 Form. After signing these documents you become responsible for the mortgage loan. In order to wire money or receive a cashiers check make sure that your funds are readily accessible in a checking account.

It provides the details of the sale transaction including the sale price amount of financing loan fees and charges proration of real estate taxes amounts due to and from buyer and seller and funds due to third parties such as the selling real estate agent. This form is required by Federal law and is prepared by the closing agent. You sign an authorization allowing your banking institution to hand-complete the form which.

- All loan applications including applications taken by mail internet or telephone must use a collection form similar to that shown in appendix B regarding ethnicity race and sex. How Close Your Own Loans mortgage products compare to other lenders. Please also note that we are unable to initiate any transfer on your behalf.

2601 et seq became effective on June 20 1975. When you apply for a loan the lender must give you a loan estimatea government-mandated form that details the terms of the mortgage it is offering you. Shorter loan terms cost less over time but have higher monthly payments.

If the requester was a US business or financial institution the will issue you a copy of the Form 1099 or 1098 that they sent to the IRS with your information. Therefore the best loan term balances your loan costs with your monthly budget. The Loan Estimate and the Closing Disclosure forms boil down all of the closing costs youll encounter when getting a home loan.

A car a boat an expensive piece of furniture. You need to provide certified funds Your final payment to escrow will need to be in certified form which is either a cashiers check or wire transfer. Required by federal law the Closing Disclosure CD is typically the first document you will review with your closing agent.

Whether or not lenders re-check your employment on the day of the closing is per lender discretion. Once these signed original documents have been submitted to the Lender all copies in your possession must be. Verifying Employment Before Closing.

Some lenders like to re-verify your it just to make sure nothing changed. Purchase Requirements 12 CFR. Just take your time both before and during your closing.

Settlement Statement - HUD-1 Form. APM has tools and resources that can help you estimate your closing costs. At least one day before closing you will receive a HUD-1 form or the final statement of loan terms and closing costs.

If youre purchasing a home with a loan the closing of your loan the time when your loan becomes final and the funds are distributed and the closing of your. Most mortgages have 15- or 30-year loan terms. Quit or switch your job.

Here are 10 things you should avoid doing before closing your mortgage loan. The Home Loan Closing Process. Again if you changed jobs this changes the entire dynamic of the loan.

Personal checks will not be accepted. Open or close any lines of credit. Report the total points on Form 1098 for the calendar year of closing regardless of the accounting method used to report points for federal income tax purposes.

Close Your Own Loan has a 1000 rate guarantee. It requires lenders mortgage brokers or servicers of home loans to provide borrowers with pertinent and timely disclosures about the nature and costs of the real estate settlement process. The funds for closing will need to come from sources that were provided to the lender AND must come from an account belonging to the person on the loan or from the donors account if there are Gift Funds.

Image Result For Letter For Grant Request To Education Department Proposal Letter Proposal Writing Sample Sample Proposal Letter

Final Approval Closing Day Overview Mortgagemark Com

Lettering Letter Templates Letter Writing Template

Mortgage Releases Why You Should Pay Attention After Closing Proplogix Mortgage Primary Teachers Feeling Excited

Loan Application Cancellation Letter Format And Example For Bank Charges Refund Letter Template In 2022 Letter Writing Examples Letter Templates Loan Application

Terms To Know Before You Start Your Home Search Real Estate Terms Home Buying Process Real Esate

Mortgage Buyout Agreement Luxury 11 Mortgage Agreement Templates Mortgage Agreement Mortgage Agreement

What Is A Loan Estimate How To Read And What To Look For

Sign The Closing Disclosure Cd Mortgagemark Com

Mortgage Loan Estimate Vs Closing Disclosure What S The Difference Mybanktracker

Fannie Mae Loan Purchase Letter Faqs Know Your Options

Loan Application Letter Loan Application Letter Is Written To Ask For Monetary Credit Service On Marketing Plan Template Lettering Application Letter Sample

What Does It Mean When A Loan Goes To Underwriting Real Estate Info Guide Underwriting Home Buying Process Home Buying

Contract To Sell On Land Contract Real Estate Contract Real Estate Forms Contract

Loan Clearance Letter From Hdfc Bank Ten Ingenious Ways You Can Do With Loan Clearance Lette Reading Lesson Plan Template Reading Lesson Plans Lettering

Right Of Rescission Period When It Starts And Ends And Why It S Necessary

Closing Cost When It Comes To Purchasing A House Estate Lawyer Real Estate Contract Real Estate

:max_bytes(150000):strip_icc()/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)

/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)

Comments

Post a Comment